2025 Section 179 Tax Savings

Learn about Section 179 Tax Savings in Utah for Your Work Vehicle

Here at Labrum Ford, we help those who have commercial vehicles from our Ford lineup use all the benefits that come with purchasing your fleet vehicles to keep your business on the go. This includes the various tax benefits you can use when filing your tax returns for the IRS. One option is the Section 179 benefit and we are here to tell you what it is, who qualifies for 2025, and make sure you remember to use the form if you're eligible.

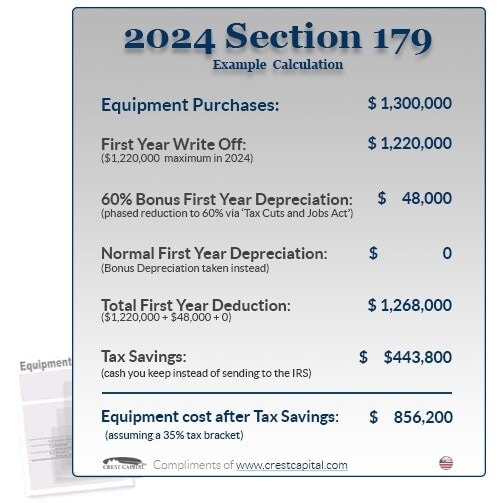

Here is an updated example of Section 179 at work during the 2025 tax year.

What Is the Section 179 Tax Benefit for Vehicles?

Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment, including vehicles, in the year they are placed into service. For those who bought a work truck or van from our Ford lineup, you can deduct the full price, provided it meets the requirements.

For vehicles to be eligible, the deduction varies depending on the type of vehicle and weight. Larger options that have a Gross Vehicle Weight Rating (GVWR) between 6,000 and 14,000 pounds are eligible for a maximum deduction of $31,300. Vehicles weighing more than 14,000 pounds, such as vocational trucks and vans available at our dealership, may qualify for the full deduction without a cap. In some cases, you can apply up to 40 percent of bonus depreciation after Section 179, to allow you to deduct more, if eligible. It's important to consult with an accountant or your accounting team for your business to see what you're eligible for and how you can gain more tax benefits. flexibility.

This benefit is a big one for many business owners around areas like Heber City, along with Provo, Park City and Salt Lake City, UT as it positively can make an impact on your business cash flow, and ensure you maximize the value and costs of your lineup of trucks and vans used for the job site.

How to Determine If You're Eligible for Section 179 for Your Work Vehicle

To qualify for the Section 179 deduction for a work vehicle, several criteria must be met. First and foremost, the vehicle must be used more than 50 percent for business purposes during the tax year. This usage must be documented, typically through mileage logs or telematics systems, to support the deduction claim. The vehicle must also be purchased (not leased) and placed in service by December 31 of the tax year in which the deduction is claimed. You cannot combine the Section 179 deduction with the standard mileage deduction in the same year, either. From there, you'd determine if your vehicles are eligible using the GVWR criteria that applies to your respective vehicle.

If you're using the deduction and have purchased a pre-owned option that is "new to you," you also can qualify with eligible vehicles. This means that if there's a fleet vehicle or commercial vehicle that you see at a lower cost, or one that is more cost-efficient, especially as a start-up business, you might be eligible for the Section 179 benefit as well.

Learn More About Your Tax Benefits for Work Trucks and Vans Today

To find out more about the Section 179 tax benefit in areas like Wasatch County and Utah County, come see us here at Labrum Ford. We can discuss which trucks or vans from our Ford commercial vehicle lineup are eligible, and we can showcase purchase options for you to buy now, and still get the benefits of this tax benefit. Contact us to find out more soon.

How can we help?

* Indicates a required field

-

Labrum Ford

901 S. Main St.

Heber City, UT 84032

- Sales: (435) 654-4910